Since last week, the Bitcoin price has witnessed heightened volatility as overhead supply at $108,000 limited recovery momentum. The market uncertainty future accelerated as Chinese AI advancement ‘Deepseek’ triggered a sell-off in Monday’s U.S. market. However, the BTC price showed notable resilience at $90k amid institutional interest signal potential for a major reversal.

Key Highlights:

- The Bitcoin price is less than 6% short of escaping a multi-month consolidation trend below $108,000 resistance.

- Nuvve Holding Corp. has integrated BTC into its reserves, planning to allocate 30% of excess cash toward BTC purchases.

- The flat pattern formation highlights $108k and $91.8k as key horizontal levels driving BTC movement.

Rising U.S. Bitcoin Holdings Signal Institutional Confidence

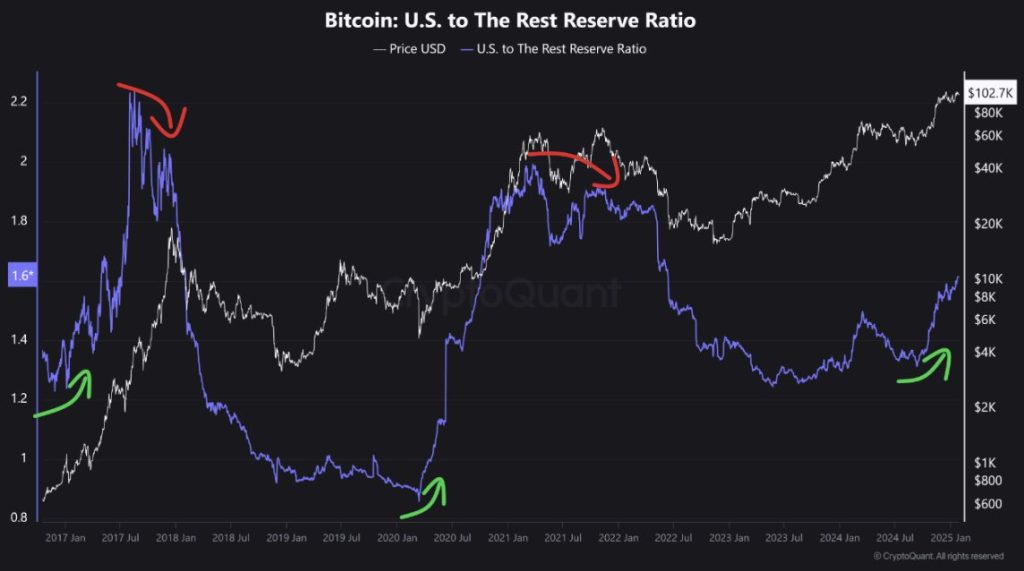

A recent tweet from CryptoQuant’s analyst suggests that the Bitcoin Bull is far from over, as U.S. entities are accumulating BTC at a faster rate than non-U.S. holders.

A notable upsurge in Bitcoin: U.S. to the Rest Reserve Ratio shows rising institutional confidence, historically aligned with the market uptrends. Furthermore, the previous peaks in this metric have conceded with the market tops, which the ongoing rally is far as per the given chart.

Moreover, the green energy technology company Nuvve Holding Corp has officially integrated Bitcoin into its treasury reserves and payment system. The Blog release shows Nuvve will allocate 30% of the excess cash toward BTC purchases, diversifying the company’s treasury holdings.

“Nuvve is geared to help modernize the grid, supporting utilities to keep the cost of energy equitable by supplying more efficient fleet-to-grid solutions and more generally multi-purpose energy storage to deliver peak power when needed,” said Gregory Poilasne, CEO and Founder of Nuvve. “BTC acceptance will promote more payment options for customers and suppliers with potentially less transactional friction inherent to digital currencies.”

Key Fibonacci Support to Watch in Bitcoin Price Correction

Over the past two months, the Bitcoin price has projected sideways action between $108,000 resistance and $91,100. The coin price has bounced twice from both horizontal trendlines, indicating no clear dominance from buyers or sellers.

However, the consolidation with respect to the 2024 end rally shows the formation of a bullish continuation pattern called ‘Flag.’ If the pattern holds true, the current consolidation should allow buyers to regain bullish momentum for their next breakout.

The Bitcoin price reclaiming key daily EMAs (20, 50, 100, and 200) accentuates the broader market trend as bullish.

An upside breakout from $108,000 will future accelerate the buying pressure to hit $125,000, followed by $150,000.

On the contrary note, a breakdown below the bottom of $91,100 will invalidate the bullish thesis and trigger a renewed correction trend.

Also Read: Tether and Medoo to Launch Blockchain Academy in Vietnam