On February 26th, Wednesday, the Bitcoin price witnessed another surge in selling pressure as the broader market plunged amid President Trump’s decision to implement 25% tariffs on the European Union. Thus, BTC plunged over 5% since yesterday to trade at $83,930, while the market cap stands at $1,673 Billion. Will the correction be extended, or can market participants expect a bottom anytime soon?

Key Highlights:

- Today’s market turbulence triggered Bitcoin’s largest capitulation since August 2024, with investors selling 79,000 BTC at a loss in the past 24 hours.

- A potential bearish crossover between the 20-and-100-day Exponential Moving Average could extend the selling pressure on BTC.

- Historical data shows Bitcoin price breakdown from 200-day ENA has bolstered for correction bottom.

Bitcoin Price Crash Triggers Largest Capitulation Since August 2024

In a three-day downfall, the Bitcoin price plunged from $96,500 to $84,650, registering a loss of 12.27%. According to Coinglass data, over 155,923 traders were liquidated in today’s dip, with the total liquidations value coming in at $623.89 million.

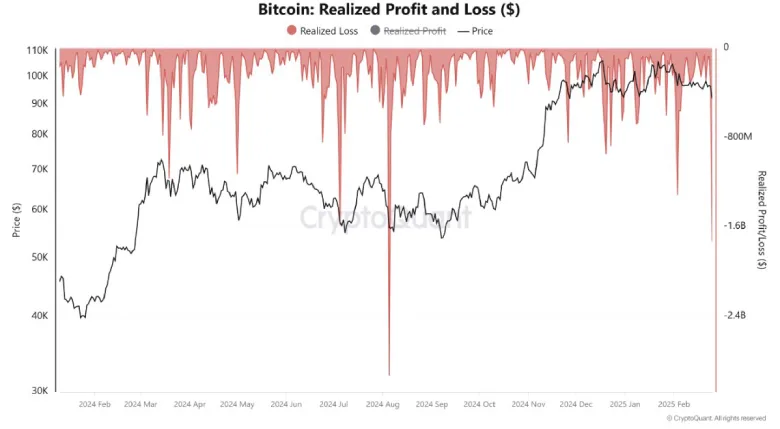

Today, Bitcoin experienced its largest capitulation since August 2024, as panic-stricken investors offloaded over 79,000 BTC at a loss in the last 24 hours. The massive sell-off, totaling more than $1.7 billion in realized losses, marks the most significant wave of capitulation in 2025 so far.

Historically, such deep capitulations have often marked key local bottoms, paving the way for price recoveries. The last similar instance saw Bitcoin rebounding from a prolonged phase of lateral consolidation, eventually surging toward $100,000 by December.

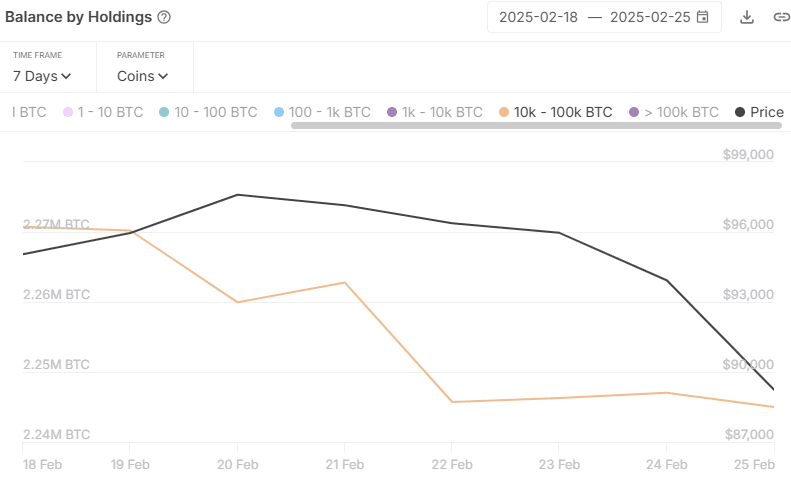

In addition, the Bitcoin’s Balance by Holding chart shows the addresses holding between 10k and 100k BTC were the primary selling during the recent dip. These entities offloaded 25,740 BTC in the last seven days.

However, the overall onchain data shows a net accumulation across Bitcoin addresses, indicating the investor maintains a buy-the-dip sentiment for this asset.

Bitcoin Price Drop Below 200-day EMA Hints Bottom Support

With an intraday loss of 5.38%, the Bitcoin price gave a decisive breakdown from the 200-day EMA slope to currently trade at $83,730. Losing this support should accelerate selling pressure in the market and prolong further market correction.

However, the historical data of Bitcoin’s uptrend since early 2023 shows the coin price has stayed below the 200-day EMA slope for less than a week to 44 days.

If this pattern continues, the BTC price could find a potential bottom in the coming five to six weeks before recuperating its uptrend for a new high.

Also Read: Andreessen Horowitz Welcomes Patrick McHenry as Senior Advisor on Tech Policy