The crypto market kicked off March with a bullish reversal, fueled by Donald Trump’s push for a U.S. Crypto Strategic Reserve. Amid the renewed buying pressure, the volatile assets of the memecoin sector, such as dogwifhat price, show a potential bottom formation.

According to Coingecko, the WIF price trades at $0.717, with a market cap of $716.2 Million and a 24-hour trading volume of $794 Million.

- A double-bottom pattern prepares dogwifhat price for a major reversal.

- The $0.79 and $0.548 horizontal levels stand as immediate resistance and support of WIF, respectively.

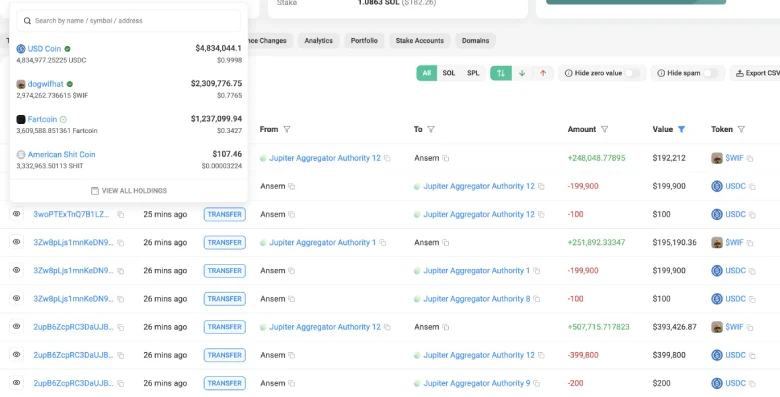

- Whale “Ansem” acquired 2.97M WIF for $2.3M USDC, signaling renewed whale interest.

Whale Accumulation Signals Bottom for dogwifhat price

Last week, the crypto market witnessed a major downturn which plunged the Bitcoin price to $80,000. While the majority of major altcoins followed similar momentum, the dogwifhat price shows firm resilience above $0.55.

The horizontal support has bolstered the memecoin 31% up to trade at $0.71 currently. This upswing is backed by renewed interest from whales, according to data sourced from Lookonchain.

A wallet identified as “Ansem” executed a substantial purchase of 2.97 million SWIF tokens at an average price of $0.77, spending a total of $2.3 million USDC.

Historically, a rise in whale accumulation has been followed by a strong bottom formation and recovery in the crypto market.

Also Read: Congressional Crypto Caucus Formed to Shape Future of Digital Assets

Double-Bottom Pattern Hints at a Bullish Reversal

An analysis of WIF’s daily chart shows the formation of a well-known reversal pattern called double-bottom. The chart setup shows a W-shaped recovery above firm horizontal support, indicating high demand pressure from buyers.

The ongoing uptrend in the momentum indicator RSI accentuates the surge in market buying pressure.

Today, the dogwifhat price plunged 8% down from the pattern’s neckline resistance of $0.79 to currently trade at $0.69. If the pattern holds true, the buyers could breach the overhead resistance and chase a potential target of $1, followed by $1.4.

Conversely, the coin price could witness a prolonged sideways trendline if sellers continue to defend the $0.79 resistance.