Aave, a decentralized protocol that allows users to lend and borrow crypto without intermediaries, is set to launch a new savings product called sGHO. This program is being launched to enhance the adoption and circulation of Aave’s stablecoin, GHO.

Benefits and Features of sGHO

The sGHO product will allow users to earn yield on GHO deposits by leveraging the native Aave lending rate and a portion of incentivized revenue from GHO borrowing. Depositors will be receiving ERC-20 voucher tokens that will accumulate value over time.

However, there will be no deposit or withdrawal fees, and the deposited GHO will not be re-mortgaged, ensuring instant liquidity and reducing smart contract risk.

Projected Growth in GHO Circulation

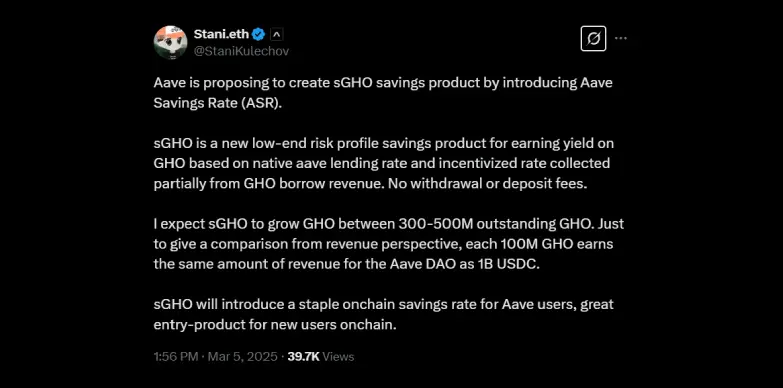

Aave founder Stani Kulechov anticipates that sGHO will increase GHO’s circulation from its current 300 million to between 300 million-500 million. He also highlighted in his tweet that for every $100 million in GHO revenue generates income equivalent to $1 billion in USDC for the Aave DAO.

This makes sGHO not only attractive to users but the users will also see the product as a major revenue driver for the protocol.

The ASR will provide a flexible interest rate supported by Aave Protocol’s revenue, which can either remain fixed or be adjusted based on market conditions.

The introduction of sGHO is expected to establish a foundational on-chain savings rate for Aave users, serving as an accessible entry point for those who are new to the decentralized finance sector.

This initiative indicates Aave’s commitment to expanding its ecosystem while offering innovative yield products to its users. The proposal is currently under governance review and has the potential to drive substantial growth in GHO adoption if approved.

Also Read: CZ Praises Vitalik Buterin’s Contribution to Crypto; Reveals Missed ETH Opportunity