The cryptocurrency market witnessed a mid-week recovery as Bitcoin price surged for a potential breakout from $100k. Despite the renewed bullish momentum, the Dogecoin price projected weakness in buyers’ conviction amid a declining trend in futures open interest. Will the selling pressure mount for a $0.2 breakdown, or buyers could counterattack?

Key Highlights:

- Since December 2024, the Dogecoin price correction has resonated within two downsloping trendlines, revealing a bull flag formation.

- A potential bearish crossover between the 50-and-100-day EMA could surge market selling pressure.

- Reduced speculation and lower Open Interest indicate weaker liquidity, making DOGE price recovery challenging

DOGE’s Futures Market Takes a Hit—OI and Funding Rate in Decline

From a late-January top of $0.43, the Dogecoin price plunged 40% down to currently trade at $0.25. Consecutively, the asset market cap plunged $37.9 Billion, while the 24-hour trading volume is at $1.13 Billion.

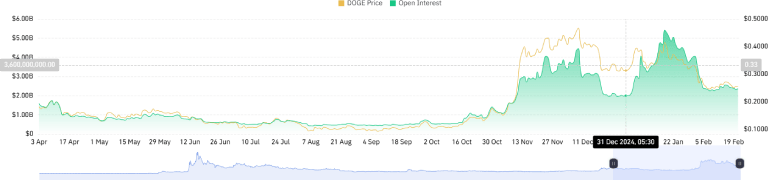

Moreover, the DOGE Futures Open Interest also fell drastically from $5.42 to $2.3 Billion, registering a loss of 57%. This sharp decline suggests that traders are unwinding their positions, leading to reduced speculation and liquidity in the market. A drop in Open Interest often indicates uncertainty, potential long liquidations, or a lack of confidence among traders in sustaining bullish momentum.

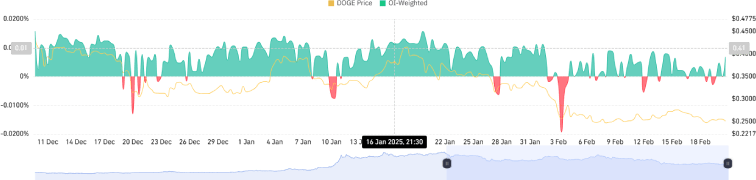

Simultaneously, the DOGE OI-Weighted Funding Rate is recording a diminishing trend in its positive region. While a typically positive value hints that buyers are paying a premium to hold long positions, a decreasing trend suggests waning bullish sentiment

Multiple Hurdles Blocks Dogecoin’s Potential for $0.3

Amid the broader market uncertainty, the downward trend of Dogecoin price has shifted sideways above the $0.24 level. The long-tail reflection at this support hints that the buyers continue to defend this support, and the memecoin could witness a renewed bullish momentum.

If true, the DOGE price could challenge the $0.285 resistance with a potential rally aiming for a $0.35 high. This potential upswing will further accentuate the formation of a continuation pattern called the bull-flag pattern.

However, with the growing market uncertainty waning traders’ interest in future markets and overhead supply, the Dogecoin price rally to $0.3 seems unlikely in the near term.

In addition, the 20-day EMA slope, as dynamic resistance, continues to project a high momentum selling pressure. Thus, a bearish breakdown below the $0.24 support accelerated the correction trend and plunged the asset below the $0.2 floor.

Also Read: GENIUS Act Support Grows as Maryland Senator Becomes Co-Sponsor