On February 27th, Thursday, the Bitcoin price witnessed a slight uptick of 1.56%, currently holding above the $85,000 level. This upswing triggers a relief rally in the crypto market as sellers likely recuperate from the high-momentum downtrend. Despite an intact demand pressure, the BTC sentiment dropped to extreme fear, hints at a history of a potential rebound.

Key Highlights:

- Bitcoin Fear and Greed Index plunged to 10 value has often led to a market bottom and subsequent rallies.

- The BTC price breakdown below the $91,500 neckline of the double-top pattern signals a risk of a 13% downfall.

- The current market correction could witness demand pressure at $80,000 and $73,800.

Extreme Fear – A Historical Perspective on Market Bottoms

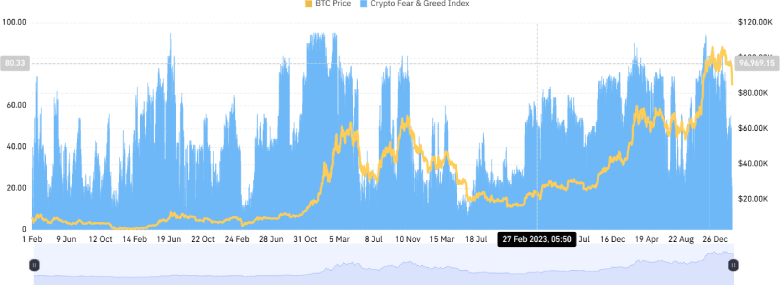

On February 27th, the Bitcoin market sentiment plunged to extreme fear of 10 — its lowest level since 2022, according to data from CoinGlass.

Historical data shows this metric plunged to single digits during the crypto winter following the LUNA/UST collapse and Celsius bankruptcy. BTC bottomed near $17,500 only to rally above $30,000 in the following months.

During the 2020 COVID-19 pandemic, extreme fear gripped the market as Bitcoin crashed below $4,000. However, within months, the Bitcoin price embarked on one of its strongest rallies, sugaring $60,000 in 2021.

Thus, such deep pessimism has often aligned with market bottoms and subsequent rallies in the near future.

Bitcoin Price Hints Extended Correction With Double Top Pattern

This week, the crypto market witnessed a sharp downfall from $96,462 to $82,440, registering a loss of 14.5%. This correction plunged the asset below the neckline of the double-top reversal pattern and the 200-day EMA slope.

However, as the market entered a relief rally, the BTC price bounced back to $85,500, while the market cap jumped $1,692 Billion. The post-breakdown retest could push the asset to $91,500 and validate its sustainability for a lower price.

If the reversal pattern holds true, the BTC price could plunge 13% down to $73,800.

On the contrary, if the retest price breaks above $91,500, the bearish thesis will be invalidated.

Also Read: Russian Hacker Group “Crazy Evil” Scams Job Seekers In Crypto Fraud