On January 28th, Monday, the crypto market projected low volatility as the prevailing bearish momentum witnessed buying pressure. The Cardano price displays this phenomenon with a long-tail rejection candle within the formation of a bullish candle continuation pattern.

Key Highlights:

- The formation of a bullish pennant pattern continues to influence the Cardano price movement.

- The $0.876 level, backed by a 100-day exponential moving average, hints at high demand pressure.

- The combination of high OI and a bullish funding rate could lead to ADA testing key resistance levels.

Cardano Futures Data Signals Growing Trader Confidence

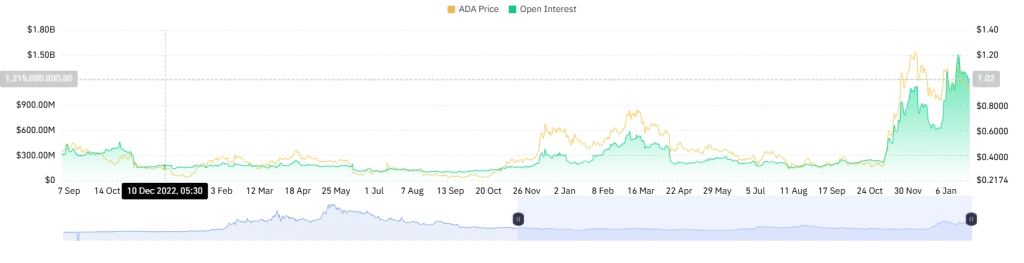

In January, the Cardano coin witnessed a notable growth in futures open interest indicating renewed growth in the derivative market. From the bottom of $619 Million, the ADA’s OI data surged to a high of $1.13 Billion, registering a growth of 68%.

Despite the recent pullback in OI, its high value implies strong market participation and sustained investor engagement, which could potentially support higher price action in the coming weeks.

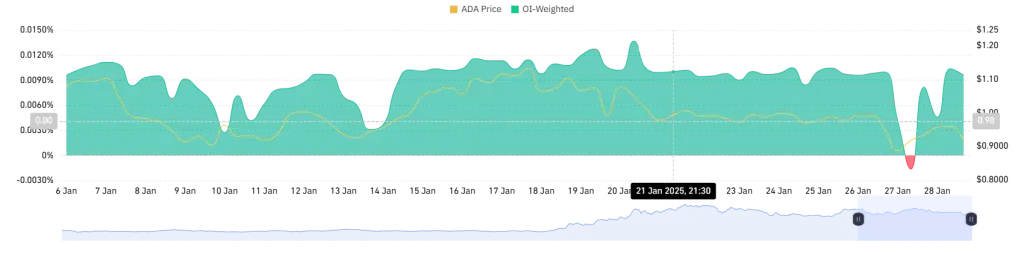

According to CoinGlass data, the ADA OI-weighted funding rate maintains a bullish narrative at 0.0104%. This positive funding rate suggests that long-position traders are paying a premium to short-position traders, implying a stronger demand for leveraged long positions.

Cardano Price Prepares Next Breakout in Pennant Pattern

In the last two weeks, the Cardano price showcased a steady correction from $1.16 to $0.85, registering a loss of 26.5%. This falling price nearly retested a key support zone of 50% from the Fibonacci retracement tool.

Theoretically, this degree of retracement is considered healthy for an asset to replenish the exhausted bullish momentum. In the daily chart, the ADA coin shows renewed demand pressure at the $0.86 level with long-tail rejection, coinciding with the 100-day EMA.

A potential reversal will signal the combination of pennant formation and push the asset 13% up for a bullish breakout. A successful flip of the overhead resistance into potential support will bolster buyers to chase the $1.68 target.

On the contrary, if sellers continue to defend the triangle resistance, the current consolidation will be prolonged for the coming weeks.

Also Read: Bitcoin Bull Run ‘Not Over’ as U.S. Reserve Ratio Signals More Upside