On March 4th, Tuesday, the crypto market witnessed another dump as countries like China and Canada imposed reciprocal tariffs in response to U.S. trade policies, fueling broader market uncertainty. Amid escalating economic tensions, the Bitcoin price retested a low of $81,463, while the second largest cryptocurrency, ETH, plunged to $1,990. The falling Ethereum price teases a breakdown below 33-month support, paving the way for further downfall.

Key Highlights:

- A downsloping trendline in the daily chart drives the current correction trend in the Ethereum price.

- A bearish breakdown from a multi-year support trendline asset ETH for an extended downfall to $1,500.

- ‘7 Siblings’ whale accumulates 4,993 ETH at $2,075, hinting an opportunity for price reversal

Ethereum Price Breaks Multi-Year Support

ETH, the native cryptocurrency of the Ethereum ecosystem, plunged from $2,523 to $2,139 — a 15% decrease — in the last 48 hours. The falling price breach below a support trendline has been intact since July 2023 and acted as a major support level for investors’ accumulation.

The daily chart is yet to show a follow-up candle to the recent breakdown and indicate price sustainability for lower levels. If the breakdown holds, the ETH price could push the asset 30% down to hit $1,500.

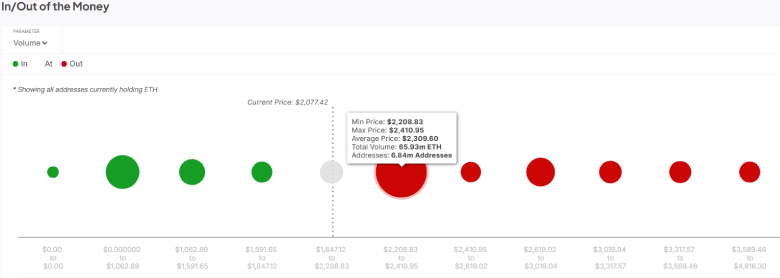

Adding to the bearish note, the Global In/Out of the Money chart shows a massive supply of 63.5 Million ETH coins held within the range of $2,208 to $2,410 by 6.84 million addresses.

This price range could act as a major resistance level, as traders currently at a loss may sell their holdings at break-even, adding to the selling pressure and potentially capping Ethereum’s price recovery.

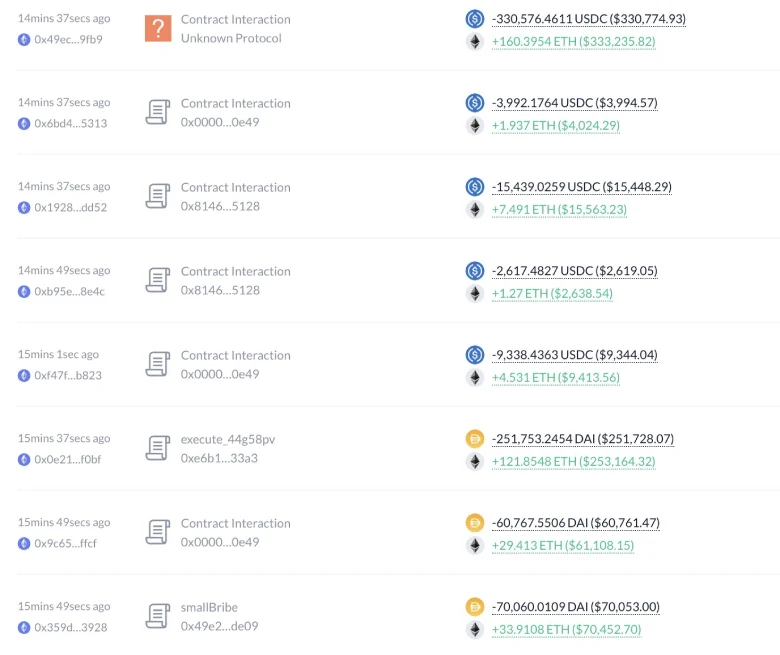

Whale Accumulation Clashes with Selling Pressure

According to Lookonchain data, the Ethereum whale known as ‘7 Siblings’ has purchased 4,993 ETH for $10.36 million at an average price of $2,075. Despite the uncertain macroeconomic backdrop, the whale continues to expand its Ethereum holdings, now controlling over 1.157 million ETH ($2.4 billion) across two wallets.

Historically, such whale accumulation has often resulted in price reversal and fresh market recovery.

However, the bearish alignment between daily EMAs (20, 50, 100, and 200) and global trade tension indicate a higher potential for prolonged correction.

Thus, savvy investors may wait for the ETH price to form the bottom and breach the overhead trendline of the daily chart to confirm the reversal.

Also Read: Bifrost Joins Fintech association of Japan to Drive Web3 and DeFi Expansion