On January 29th, Tuesday, the crypto market showcased a bullish outlook as the Federal Reserve confirmed maintaining the federal funds rate at 4.25% to 4.50%, aligning with market expectations. The Fed’s decision bolstered Bitcoin price for a reversal from $100k support, while the Ethereum price sustained its position above the $3,000 floor. The ETH coin shows potential for higher recovery amid an open interest surge and reversal pattern.

Key Highlights:

- A falling wedge pattern drives the current correction in Ethereum price.

- The $3.000 floor, backed by a 200-day exponential moving average and 50% Fibonacci retracement level, creates a high accumulation zone for buyers.

- A sharp increase in ETH futures OI and funding rate hints at an impending price reversal.

ETH Open Interest Growth Signals Market Shift

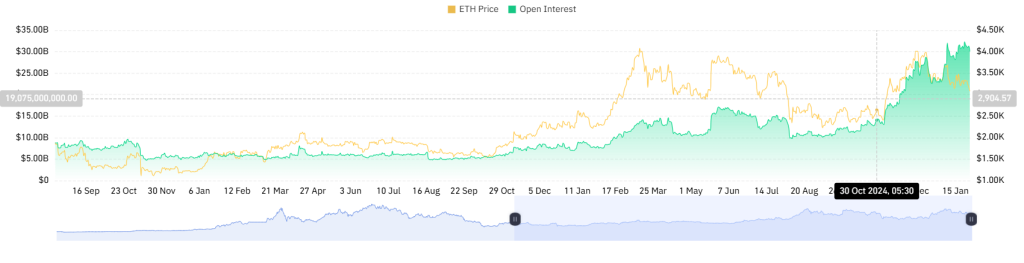

According to CoinGlass data, the ETH Futures Open Interest has surged drastically from $23 Billion to $32.25 Billion— a 40.2% increase in January. The rise in open interest suggests that more trades are entering the ETH futures market in anticipation of potential price movement.

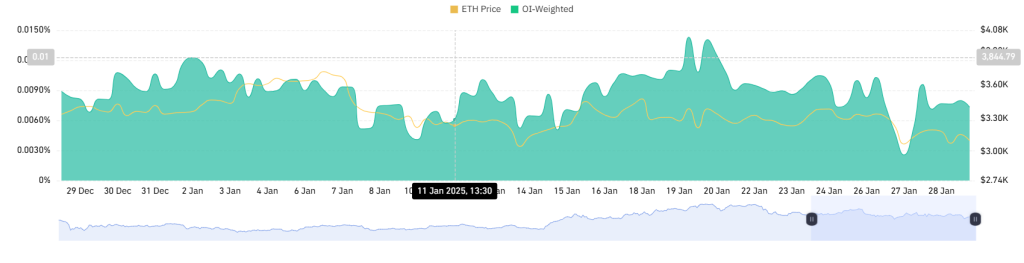

While an increase in open interest suggests rising speculative activity, the ETH OI-Weighted Funding Rate provides deeper insights into market sentiment. Currently, a positive value of 0.008% indicates the buyers are paying a premium value to hold Ether, reflecting their confidence for impending reversal.

Ethereum Price at Make-or-Break Moment

Since last week, the Ethereum price recorded a notable downturn from $3,427 to $3,157, accounting for an 8% drop. The bearish turnaround in the daily chart reveals the formation of a falling wedge pattern.

Over the past six weeks, the ETH coin has resonated strictly within the two covering trendlines of the pattern, indicating its credibility and influence on price movement. As the asset is nearing the apex of the wedge formation, the price is less than 4% from an excessive breakout of the current correction.

The post-breakout rally could drive the rally past $4k, registering a potential growth of 30%.

Alternatively, the Ethereum price is barely maintained above the combined support of the 200-day EMA and 50% FIB at $3,143. A potential breakdown will accelerate the selling pressure and drive a prolonged correction below $3,000.

Also Read: Trump’s Media Company Ventures into Cryptocurrency With TruthFi