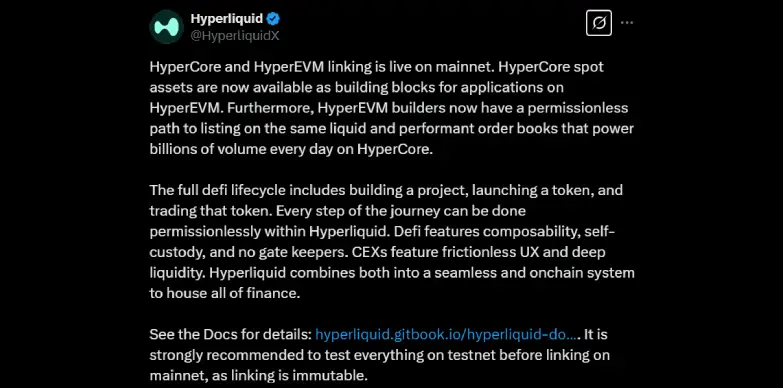

Hyperliquid has announced on its social media platform X (Twitter), the launch of HyperCore and HyperEVM linking, which is one of a significant milestone in the world of blockchain interoperability. This integration will allow seamless transfers of spot assets between HyperCore and HyperEVM, with Core spot assets now accessible for decentralized applications (dApps) on Hyper EVM.

According to the document released, developers can link core spot tokens to ERC20 contracts, opening new gateways for DeFi projects.

Permissionless Access to High-Performance Order Books

The integration is noteworthy as it does not require any prior authorization or approval. Builder can list tokens on HyperCore’s high-performance order books, which handle billions in daily trading volumes without intermediaries.

This innovation combines the deep liquidity of centralized exchanges (CEXs) with the composability and self-custody of decentralized finance (DeFi), creating a unified ecosystem for token creation, trading, and project development.

HYPE: Native Gas Token of HyperEVM

Currently, the system supports HYPE, the native gas token of HyperEVM, as a special case. Transfers between HyperCore and HyperEVM are facilitated through system addresses and ERC20 contracts, ensuring smooth asset movement. For example, HYPE transitions seamlessly between its roles as a gas token on EVM and a spot asset on Core.

Benefits of using HyperCore and HyperEVM together

This combination also optimizes transaction speeds, reduces gas fees, and supports efficient execution through the HyperBFT consensus mechanism. This makes it ideal for scalable and cost-effective DeFi applications.

Moreover, HyperCore provides a high-performance order books for spot and perpetual trading, ensuring deep liquidity for tokens issued on HyperEVM. This eliminates the fragmentation seen in traditional DeFi platforms.

By sharing the same state between HyperCore and HyperEVM, the system avoids cross-chain bridge risks, ensuring secure transactions.

This development is set to transform the blockchain industry by enhancing the interoperability and reducing barriers to entry for developers. This integration is also promoting innovation by providing a framework for DeFi applications while leveraging HyperCore’s liquidity infrastructure.

Additionally, it simplifies the DeFi lifecycle, from token issuance to trading on a single platform. This move again is set to increase adoption by offering users and developers an efficient scalable environment for financial operation across chains.

Also Read: Conflux Resolves CREATE2 Opcode Vulnerability, No User Funds Lost