On March 4th, Tuesday, the crypto market rebounded despite the escalating trade policy tension between the United States, China, and Canada. The Bitcoin price managed to hold the $90,000 mark, driving a relief rally among altcoins. For a potential rebound, the Litecoin price sets an optimal position of accumulation trend to drive a 35% surge.

Key Highlights:

- The $140 and $94 stand as major resistance and support for Litecoin price, respectively.

- The momentum indicator RSI plunged to 38%, indicating a bearish sentiment, which previously triggered over 50% recovery.

- The $89.08–$108 range holds 17.8M LTC tokens & 11M addresses, acting as a major support level.

Litecoin Price Key Accumulation Zone Strengthens Bullish Momentum

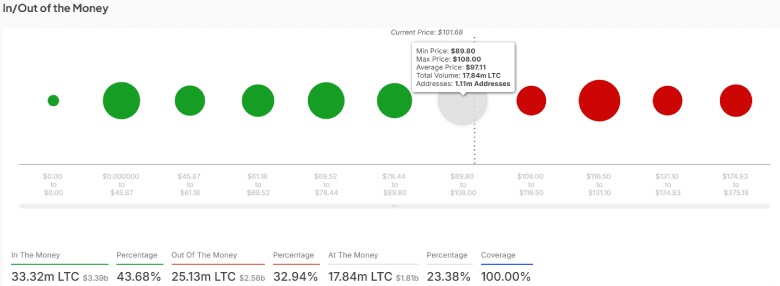

According to the Global In/Out of the Money chart, the Litecoin price range of $89.08-$108 holds a substantial supply of 17.8 Million LTC tokens and 11 million addresses. This price range could act as a major support level and accumulation zone for buyers.

The GIOM metric from IntoTheBlock analytics signals a bullish outlook for Litecoin’s price. Currently, 43.68% of LTC volume (33.32M LTC) is in profit (‘in the money’), while 32.94% (25.13M LTC) is at a loss (‘out of the money’).

This distribution suggests strong price stability, as the majority of investors are in profit, reducing the likelihood of panic selling and supporting a sustained uptrend.

Key Support Levels and Accumulation Zone Strengthen Bullish Outlook

For the past three months, the Litecoin price has been strictly resonating between the horizontal level of $140 and $94, revealing a rectangle pattern. The coin price rebounded multiple times from the aforementioned levels, accentuating the credibility of this structure.

By the press time, the LTC trades at $102.9, and its -6.3% red candle shows a long-wick rejection candle at $94 level, indicating the intact demand pressure. If broader markets rebound, the coin price will rise 35% to challenge the overhead resistance.

A potential breakout from $140 is crucial for buyers to resume the prevailing uptrend.

Also Read: Ethereum Price Crashes Below 33-Month Support – Is $1,500 Close?