UNI, the native cryptocurrency of the decentralized exchange Uniswap, jumps by +5 during Wednesday’s trading session. The buying pressure followed a relief rally in Bitcoin as market pressure eased from the ongoing tariff war between China and Canada with the United States.

However, a potential supply pressure from whales/institutions indicates the sellers could replenish the bearish momentum for prolonged correction, WIll the UNI price lose a $6 floor?

Key Highlights:

- A six-month-long support trendline drives the current uptrend in Uniswap price.

- The 100-day Exponential Moving Average nearing a bearish crossover with the 200-day EMA could accelerate market selling pressure.

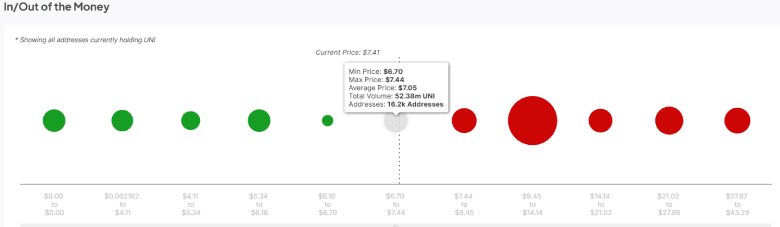

- Global In/Out of the Money (GIOM) metric shows weak buyer support, with only 8.78M UNI held between the $6.7-$6.18 range

Institutions Movements and Weak Support Levels Raise Bearish Concerns

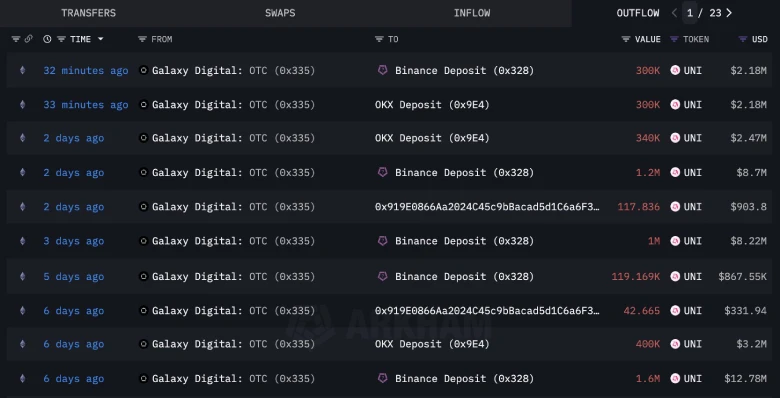

According to the blockchain data tracker, Galaxy Digital has ramped up its UNI token deposits, transferring an additional 600,000 UNI (valued at $4.37 million) to Binance and OKX just 30 minutes before reporting.

This latest deposit adds to a significant outflow of 5.26 million UNI (worth $40.6 million) that Galaxy Digital has moved to major centralized exchanges over the past week.

This transfer suggests a potential sell-off or strategic repositioning by the firm, raising market speculation of further downfall.

Adding to the bearish note, UNI’s Global In/Out of the Money (GIOM) metric shows weak supply presence protecting key support levels. The Uniswap price range of $7.4-$6.7 holds a supply of 52.8 Million UNI among 16.2k Addresses, while $6.7-$6.18 price holds 8.78M among 19.85k Addresses.

The above chart illustrates squeezed green spheres, indicating a weak support zone for buyers.

Technical Indicators Suggest a Potential 17% Drop for UNI

In the last two days, the Uniswap price bounded from the support of $6.47 to $7.2 in current trading, projecting a gain of 15%. The uptick followed a broader market relief rally despite the escaping tariff war among countries like the U.S., China, and Canada.

While the surge in buying pressure could push UNI price to $8.5, the market trendline is yet to confirm a bullish reversal. The downsloping daily EMAs (20, 50, 100, and 200) indicate the path to least resistance is down and market sentiment is negative.

Thus, the coin price could likely revert and breach $6.5 support, paving the way for a 17% fall to $5.5. The aforementioned support, backed by an ascending trendline, provided major support for crypto buyers.

Also Read: Ethereum MVRV Signals Deep Undervaluation – Is a Rebound Imminent?