On February 20th, Thursday, the crypto market experienced a bullish turnaround, with Bitcoin price nearing a $100k breakout. Amid the renewed recovery in the market, the SEI coin recorded a 13% rally following a substantial accumulation from World Liberty Financial and a bottom support reversal. Is the bullish momentum sufficient to reclaim the $0.5 mark?

Key Highlights:

- The $0.2 support stands as a key bottom support for SUI buyers.

- The 20-day exponential moving average stands as the key resistance breakout for buyers to regain trend control.

- Large-scale purchases indicate institutional interest in SEI and WLFI tokens.

World Liberty Financial Bets Big on SEI Amid Market Consolidation

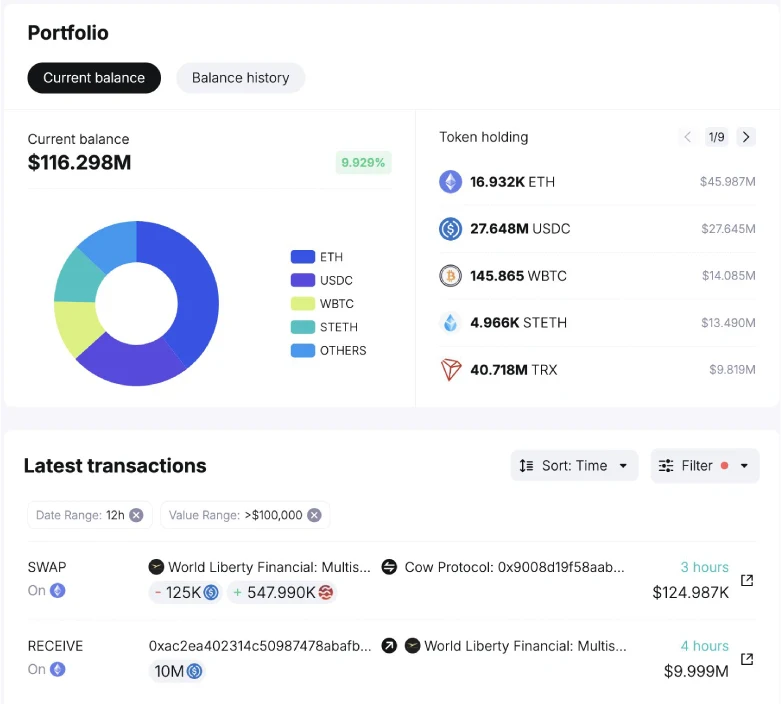

Amid the broader market consolidation, Donald Trump’s World Liberty Financial has shown interest in the emerging DeFi token, SEI. According to Spot On Chain, World Liberty Financial spent $125,000 USDC to acquire 547,990 SEI on the Ethereum network approximately three hours ago from reporting.

Simultaneously, two newly created multi-signature wallets—reportedly linked to the same entity—have amassed 400 million WLFI tokens with a massive $20 million USDC investment over the past two days.

Such growing institutional interest and large-scale accumulation should bolster SEI and WLFI coins for bottom formation and sustained recovery.

According to DeFiLlama data, the SEI total volume locked has recently bounced from $166 Million to $200.8 Million — a 20% increase — in the last two weeks. The increase in TVL suggests a growing trust in SEI’s ecosystem, with more capital being locked into its DeFi protocols.

SUI Price Gains Momentum at Multi-Month Support

Over the last two months, the SEI price showcased a massive correction from $0.73 top to August 2024 bottom of $0.2, registering a loss of 71%. Amid the market uncertainty, the coin buyers managed to hold the aforementioned support and shift the falling price sideways.

As World Liberty Financial continues to reflect its growing support for the decentralized finance sector, the SEI coin has managed to rebound 30% up to $0.26. Consecutively, the asset market surged to $1.23 Billion.

However, the declining trend in daily EMAs (20, 50, 100, and 200) indicates multiple overhead resistance and bearish market sentiment. Thus, the SEI price could prolong its consolidation at $0.2 before renewing the bullish momentum for sustained recovery.

With the support of a bullish reversal pattern, the coin price could remain at $0.5 in the coming months.

Also Read: GENIUS Act Support Grows as Maryland Senator Becomes Co-Sponsor